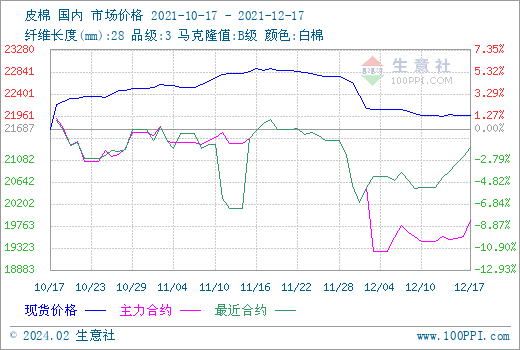

1. Price Trends

According to data from SunSirs, the price of 3128B lint cotton was around 21,966 yuan/ton on December 17, down 11 yuan/ton from last weekend, down 407 yuan/ton from the beginning of the month, and down 3.96% from the previous month.

2. Market analysis

The cotton market fluctuated and consolidated this week. On the 17th, the domestic cotton price index 3128B level average price was 21,876 yuan/ton, down 7 yuan/ton from last weekend. National cotton production data released by the National Bureau of Statistics show that the national cotton production in 2021 is 5.731 million tons, a decrease of 180,000 tons or 3.0% compared with 2020. As of the end of November, the total national cotton commercial inventory was 4.5521 million tons, a significant increase of 1.7157 million tons from the previous month and a decrease of 18,600 tons from the same period last year; the cotton industrial inventory in November was 849,700 tons, an increase of 5,200 tons from the previous month. At present, the cost of new cotton is high, and textile companies mainly reserve cotton in the early stage and import cotton. In terms of imported cotton, due to the tight global transportation capacity, rising freight costs, and the lack of willingness of enterprises to order under the continued high cotton price, the new arrival volume of domestic imported cotton has not seen a significant improvement.

In terms of futures, Zheng cotton prices fluctuated upward this week, and the settlement price on the 17th was 19,880 yuan/ton, an increase of 425 yuan/ton from last weekend, an increase of 2.18%. In terms of ICE futures, benefiting from the decline in the U.S. dollar index, combined with the recent increase in U.S. cotton signings and the decline in global inventories, the March ICE cotton futures contract on the 16th was 109.68 cents, an increase of 389 points from the previous day; the May contract was 107.93 cents, an increase from the previous day. It rose 356 points in one day.

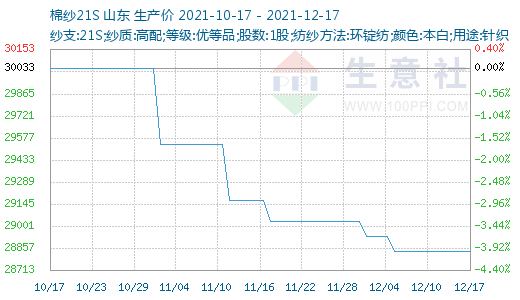

3. Downstream industrial chain

The spot market of cotton yarn is declining. The current cotton yarn inventory is under great pressure, which is much higher than the same period last year. The overall market demand is insufficient. As of the end of November, the yarn inventory of textile enterprises is 25.36 days, an increase of 3.69 days from the previous month; the gray fabric inventory is 31.89 days. , an increase of 3.85 days compared with the previous month. In the past month and a half, the cotton yarn market has been in a downward channel. Although the upstream cotton market is supportive, downstream demand has been sluggish for a long time. Textile companies are more resistant to high cotton prices, and costs are not transmitted smoothly to the downstream. A number of listed companies, polyester factories, weaving factories, and printing and dyeing factories in Zhejiang have been affected by this round of epidemic and have suspended operations and production. Due to the improvement of the prevention and control level, the entry and exit of raw materials and finished products of weaving factories, as well as the normal delivery time of printing and dyeing factories have appeared. varying degrees of impact.

Towards the end of the year, downstream weaving and clothing companies are troubled by multiple factors such as insufficient orders, tight funds, and concerns about the spread of the new coronavirus epidemic. Price reductions to destock and withdraw funds have become the mainstream trend, further exacerbating the downward trend in prices. Textile companies are facing The market outlook is generally cautious and it is expected that the market will continue to be weak before the end of the year. </p