Since 2022, affected by factors such as the recurrence of a new round of epidemics and the escalation of the situation between Russia and Ukraine, the global supply and demand imbalance has intensified. The violent fluctuations in commodity prices have triggered unexpected inflation and Financial markets continue to be turbulent, and risk factors on both supply and demand sides continue to accumulate, dragging down the prospects for global economic and trade growth. In April, the J.P. Morgan Global Manufacturing Purchasing Managers Index (PMI) was 52.2. Although it was in the expansion range, it was affected by shrinking global export orders and increasing downward pressure on the Chinese economy. Affected by factors, the output index fell for the first time in 22 months; the OECD consumer confidence index was 97.3, which has been in the contraction range for nine consecutive months. The rebound of the epidemic and supply chain shocks have inhibited the recovery momentum of global merchandise trade. The World Trade Organization (WTO) global goods trade barometer index in the first quarter was only 98.7, continuing the contraction below the trend level since the fourth quarter of 2021. International commodity prices have risen rapidly since March, and the risk of global economic stagflation has increased. Inflation rates in major economies such as the United States and the European Union have hit a 40-year high.

Figure 1: Trends in major global macroeconomic indicators

Data source: IHS Markit, WTO, OECD, National Development and Reform Commission Price Monitoring Center

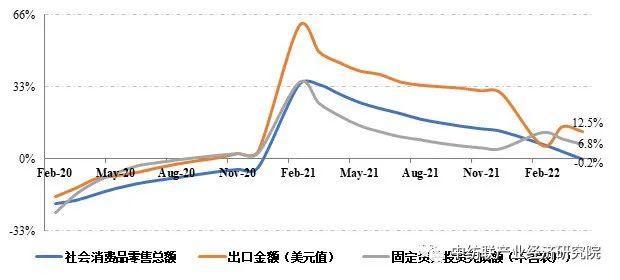

Driven by the effects of policies to stabilize growth, my country’s macro-economy achieved a stable start in the first two months. However, since March, affected by unexpected factors such as the frequent spread of domestic epidemics, poor operation of industrial and supply chains, and weakening market expectations, the economy has Downward pressure is gradually increasing. Statistics show that in the first quarter of 2022, my country’s GDP increased by 4.8% year-on-year, and the economic growth rate ranked among the top of the world’s major economies. Affected by the rebound of the epidemic, some companies suspending production and reducing production, and the continued decline in market demand, my country’s manufacturing prosperity level continues to decline. The manufacturing purchasing managers index (PMI) in April was lowered to 47.4 from 49.5 in March, continuing to be below the critical point. From January to April, the industrial added value of enterprises above designated size increased by only 4% year-on-year, with the growth rate falling 16.3 percentage points from the same period last year and continuing to slow down by 2.5 percentage points from the first quarter of this year. During the same period, my country’s total retail sales of consumer goods decreased by 0.2% year-on-year. Total exports (USD value) and fixed asset investment completion (excluding farmers) increased by 12.5% and 6.8% respectively year-on-year. The growth rates fell by 29.8, 31.5 and 31.5% respectively compared with the same period last year. 13.1 percentage points.

Figure 2: my country’s GDP year-on-year growth rate

Data source: National Bureau of Statistics

Figure 3: Cumulative year-on-year growth rate of my country’s “Troika” indicators

Data source: National Bureau of Statistics, China Customs

The textile industry has entered a low-speed growth range, and the growth rate of major economic operation indicators other than investment has generally declined compared with the same period last year. Against the background of slowing macroeconomic growth and the continued spread of the epidemic, consumer demand for textile and apparel products is relatively sluggish, and the order situation in the traditional peak seasons of “Gold, Three, and Silver” is weaker than the same period in previous years and expected. Under the static management measures of the epidemic, enterprises’ raw material procurement, finished product shipments and normal production have all been affected to a certain extent, and export orders have been lost and domestic sales orders have been returned. Faced with the phased dilemma of “high cost, weak demand, and high inventory”, the operating rates of major industrial chain links such as chemical fiber, spinning, weaving, and printing and dyeing have all decreased. Profit pressure is more significant, and corporate sentiment is weaker than the current data. The performance shows that the differentiation trend among enterprises, industrial chains and sales channels is obvious, and the cash flow of some small and micro enterprises tends to be tight. The China Textile Federation, some professional associations, and the Jiangsu Provincial Garment Association promptly carried out key investigations. According to the investigation, the current key industrial clusters and enterprises in the epidemic-related areas have basically resumed normal production. , the resumption of production after the May Day holiday is generally normal, the textile and clothing professional market has gradually resumed business, and logistics is smooth in most areas. However, high transportation costs have further increased the operating pressure of enterprises, and the pressure on the terminal links of the industrial chain has become more prominent.

In the second half of the year, the complex domestic and international situation increased the development pressure on the textile industry, and companies generally lowered their development expectations. The bleak economic prospects, the epidemic that has not yet been effectively controlled, and the ongoing geopolitical crisis will all reduce residents’ actual purchasing power and willingness to consume. The growth of domestic and foreign sales in the textile industry faces many constraints, and weak market demand is difficult to support industry companies. Resolve the pressure of higher raw material, transportation and labor costs. Textile companies need to actively take advantage of my country’s series of corporate bailout measures and loose monetary policies to continue to promote product, equipment, and process innovation.��Upgrade, explore consumption hot spots, and smoothly survive the period of superposed supply and demand pressures.

AAA anti-UV fabric network SDFERHYTJTI